Using SureCloud GRC to link data and spot control gaps

Streamlining Risk and Compliance with SureCloud

Helping Mollie tie disparate processes together, while fully integrating them in an easy-to-use risk and compliance solution.

The Mollie Challenge

Challenge

The online payments sector is one of the most dynamic markets in the financial world. It’s come on leaps and bounds in the past decade, with advancements in technology constantly pushing the boundaries of what’s possible.

If merchants are to grow and be successful, they need to present a variety of payment options. Mollie helps merchants tackle this challenge, offering a simple and clear API that offers multiple payment methods in a concise, uniform way. However, beyond the technology, there are a number of compliance, security and risk challenges that the online payments sector faces.

When Mollie partnered with SureCloud, the company already had a dedicated risk and compliance function, but its technology supporting the team needed to be modernized if the company was to take advantage of the growth opportunities it had identified.

The company’s primary focus was around integrity, IT, cyber, operational and data privacy risk, and Mollie needed a platform to monitor and manage all aspects in an easy, simple way before they began their program expansion.

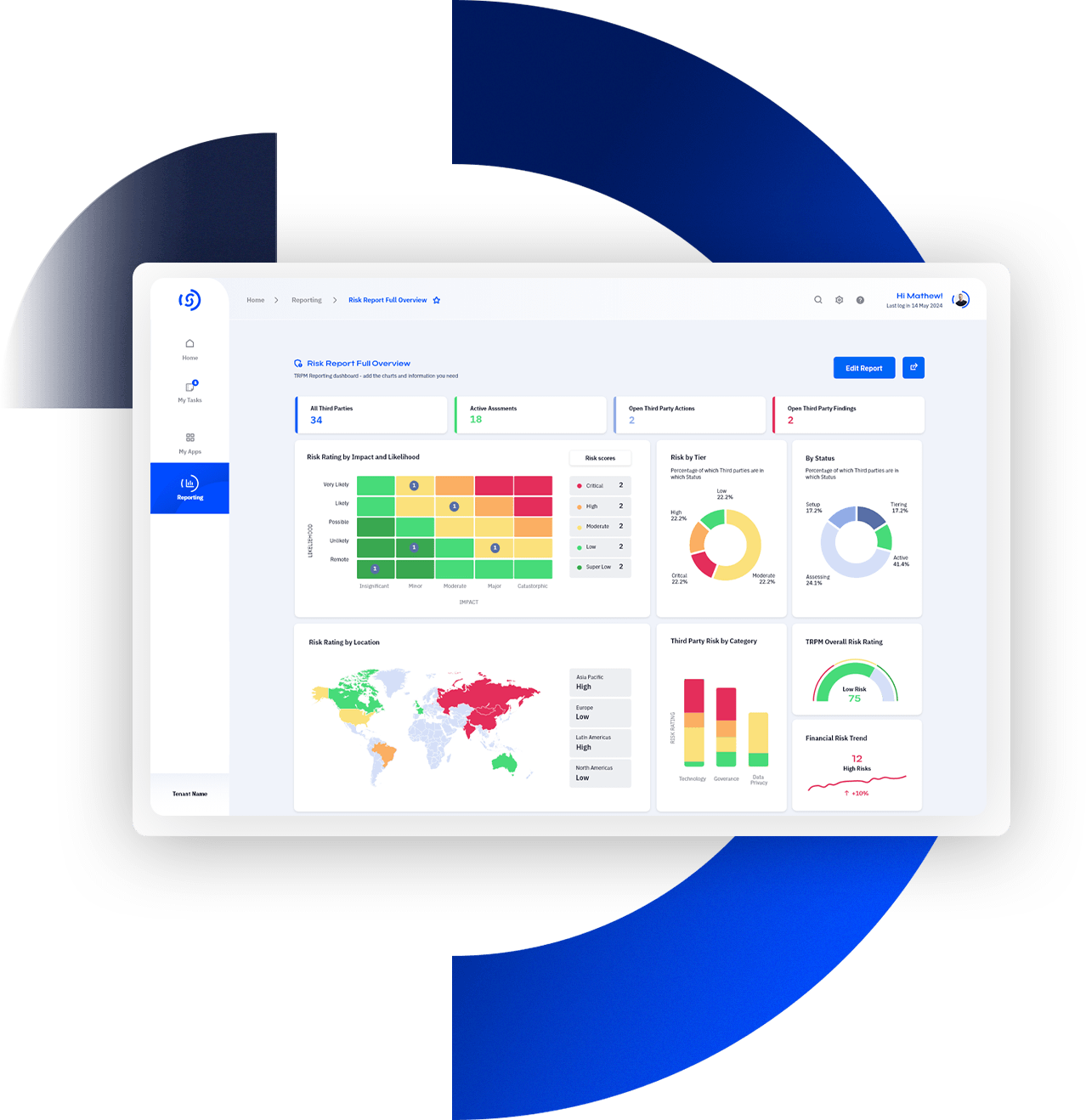

Mollie wanted an end-to-end solution that would allow them to easily link data together and spot control gaps.

User experience was of paramount importance, and Mollie wanted an interface that even non-compliance/risk employees would be able to use effectively with minimal training.

Solution

SureCloud’s solution is designed to help organisations like Mollie tie disparate processes together, while fully integrating them in an easy-to-use risk and compliance solution.

The primary goal is to eliminate duplicate work, lower administrative overhead, eradicate manual reporting, and reduce the need for additional manual communications such as email-based instructions.

This results in better record-keeping, easier decision-making, and the ability for the business to demonstrate how risk, compliance, security and data privacy impact the organisation today and any future growth plans.

Through SureCloud, businesses can effectively demonstrate and manage regulatory compliance requirements with an interactive dashboard that displays connections to controls assessments, risk and remedial actions.

“We’re already enjoying better visibility with more detailed information and insights”

“This is only the tip of the iceberg in terms of what will be possible as we continue with the implementation.

In an age where compliance and data security are of paramount importance, financial organizations like ours must demonstrate that we’re in control. SureCloud is helping us to gain that control and demonstrate it in a clear, organized way.

We’re still in the deployment phase at the moment, but we can already see the incredible potential and we can’t wait to continue to the rollout; the implementation and support team have been extremely helpful.”

Eline van der Lugt, Head of Risk at Mollie

Integrated GRC that’s right for you

The apps Mollie use to streamline GRC

Contiunous Control Monitoring

Proactively Manage Risk and Compliance with Continuous Controls Monitoring

Contiunous Control MonitoringComplaince Management

Manage, continuously test and report on your compliance status

Compliance ManagementRelated Resources

- Compliance

Achieve NIS-2 Compliance with Confidence - Whitepaper

Your essential guide to NIS-2 compliance: navigate key requirements, mitigate cybersecurity risks, and streamline compliance with SureCloud’s powerful GRC platform.

Read More- Compliance

- DORA

Ensure DORA Compliance: Download the Essential Cheatsheet

Download SureCloud’s free cheat sheet on DORA, covering key compliance areas like risk management and resilience testing. Be DORA-ready today

Read More- Compliance

The Guide to Security Compliance Maturity

Download SureCloud’s Guide to Security Compliance Maturity. Discover a proven roadmap to enhance compliance, reduce regulatory risks, and build operational resilience across your organization.

Read MoreExplore more case studies

"SureCloud gave us the flexibility to design our own user journeys and reporting tools."

How Autotrader are automating and streamlining their risk and compliance programs with SureCloud

Read Case Study

"It's dynamic and agile — if we want to get a snapshot of risk for a particular department or function, we can."

How Office for Students underpinned their risk management culture with SureCloud.

“SureCloud’s solution has brought a comprehensive clarity to data processing that was impossible to achieve with spreadsheets.”

How Everton FC spend 75% less time documenting their processing activities and data protection impact assessments