Proactive Compliance. Assured Resilience.

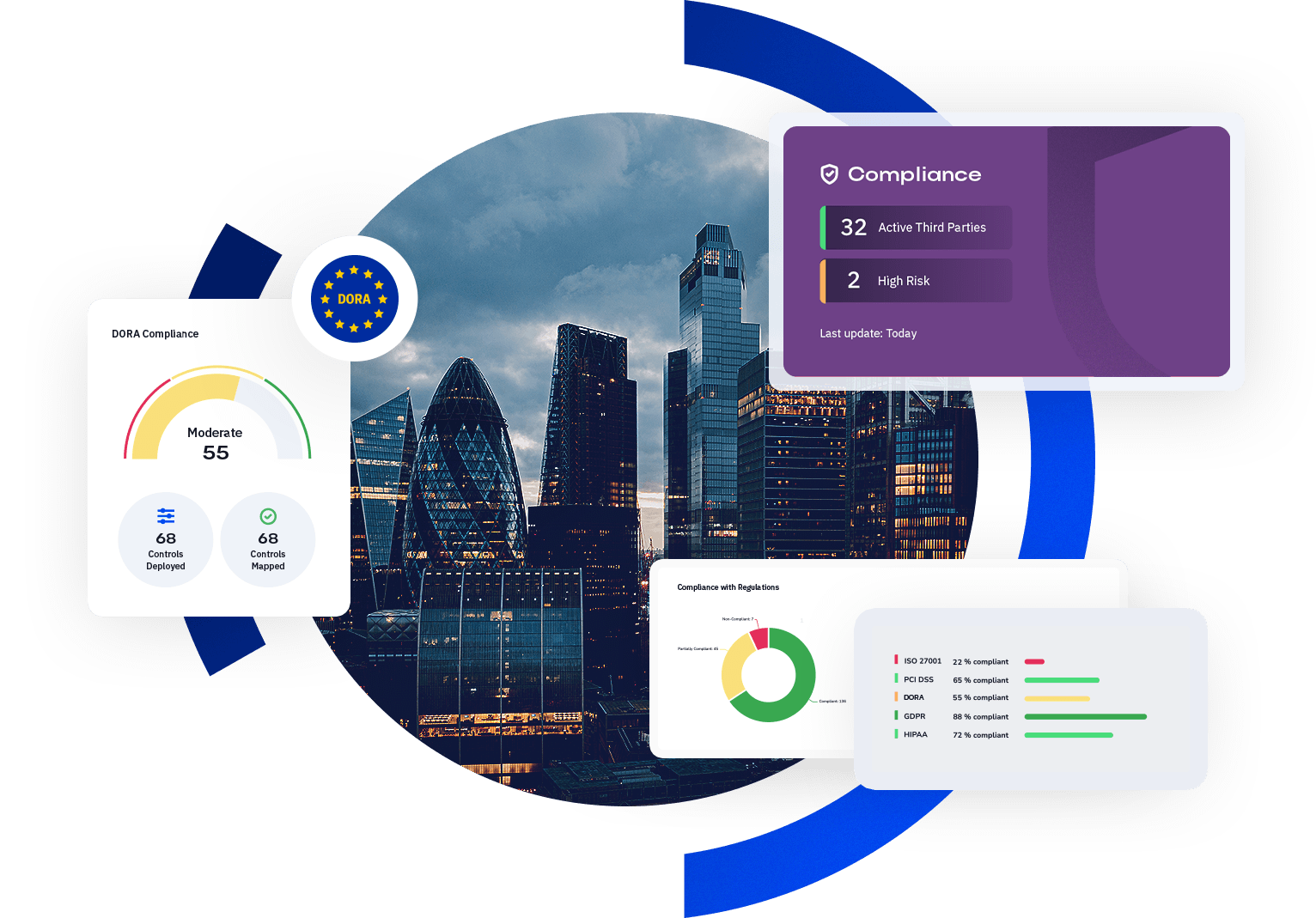

Stay ahead of DORA compliance deadlines with SureCloud

Navigate DORA Compliance with Confidence

SureCloud empowers financial institutions to simplify compliance, strengthen resilience, and safeguard critical operations

What is DORA?

The EU’s Digital Operational Resilience Act (DORA) strengthens IT security for financial institutions, ensuring they can withstand cyber threats and disruptions. Compliance is mandatory by January 17, 2025.

Why Compliance Matters

Non-compliance can result in severe penalties, reputational damage, and operational risks. Ensure your organization is prepared to meet regulatory demands and protect its critical operations.

Key Compliance Requirements

DORA outlines several critical requirements for financial entities:

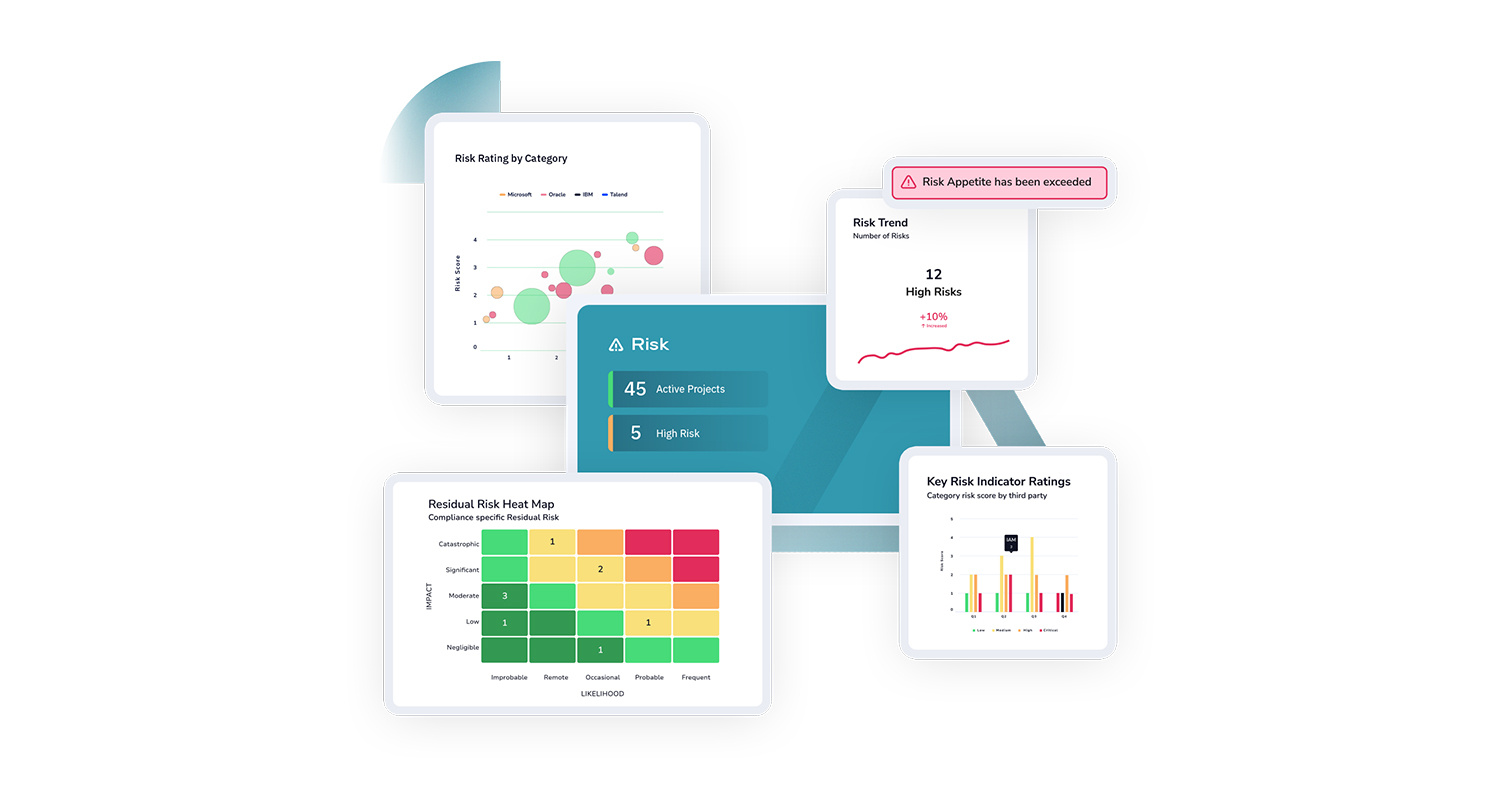

IT Risk Management

Establish and maintain robust frameworks to manage IT risks effectively.

Incident Reporting

Ensure timely detection and reporting of IT-related incidents.

Resilience Testing

Conduct regular assessments like vulnerability scans and penetration testing.

Third-Party Risk Management

Mitigate risks associated with external IT service providers.

Information Sharing

Collaborate on cyber threat intelligence for enhanced resilience.

Why Choose SureCloud for DORA Compliance?

The Trusted Partner for Simplifying Compliance and Building Resilience

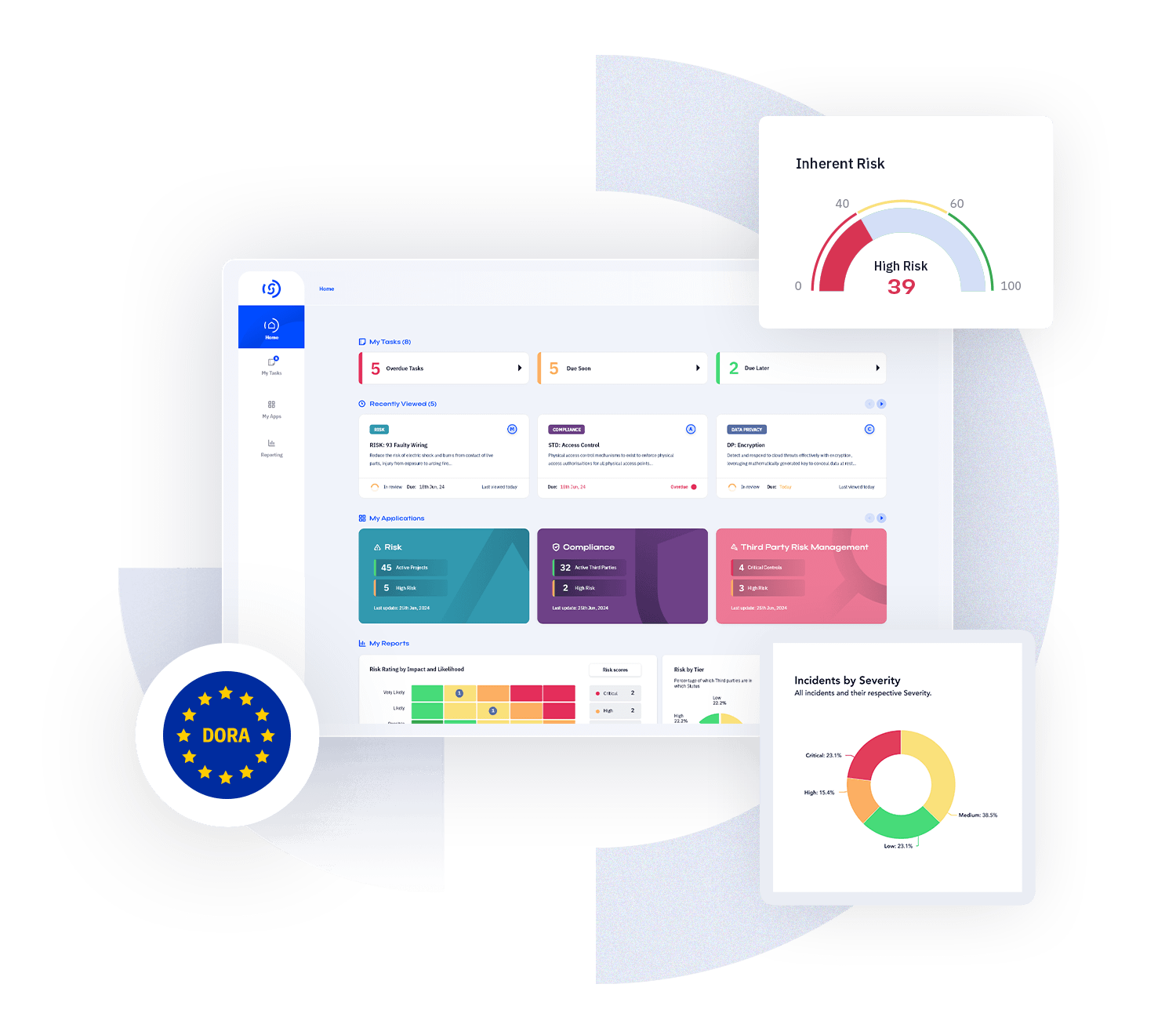

Dynamic Risk Intelligence

Gain real-time insights into regulatory risks and make proactive decisions with our unique DRI technology.

Comprehensive Coverage

Streamline your IT risk management, incident reporting, resilience testing, and third-party oversight in one platform.

Proven Expertise

With over 18 years of experience, SureCloud is a trusted partner for financial institutions globally.

Seamless Integration

Integrate compliance management seamlessly with your existing tools and workflows. Join organizations like Prodigy Finance who rely on SureCloud to navigate regulatory complexities confidently.

Ready to simplify your path to DORA compliance?

GRC transformation delivered

"SureCloud gave us the flexibility to design our own user journeys and reporting tools."

How Autotrader are automating and streamlining their risk and compliance programs with SureCloud

"It's dynamic and agile — if we want to get a snapshot of risk for a particular department or function, we can."

How Office for Students underpinned their risk management culture with SureCloud

“In SureCloud, we’re delighted to have a partner that shares in our values and vision.”

How Mollie has achieved a data-driven approach to risk and compliance with SureCloud.

"We wanted to collate this into a single platform for greater efficiency, which we've now been able to achieve with SureCloud."

How Barratt achieved efficient and effective management of their GDPR obligations

"SureCloud's solution has brought a comprehensive clarity to data processing that was impossible to achieve with spreadsheets."

How Everton FC spend 75% less time documenting their processing activities and data protection impact assessments

"It's dynamic and agile — if we want to get a snapshot of risk for a particular department or function, we can."

How Office for Students underpinned their risk management culture with SureCloud